Opening a bank account in Switzerland is not illegal. Many people decide to do so because they are going to work in Switzerland; because they think it is a safer country or because they want to set up a business there. Being a country with low corruption and great economic strength, savers feel safer having their savings in Swiss neobanks or banks. Even changing their currencies to Swiss francs, which is the currency of that country.

In which Swiss bank should I open a non-resident account?

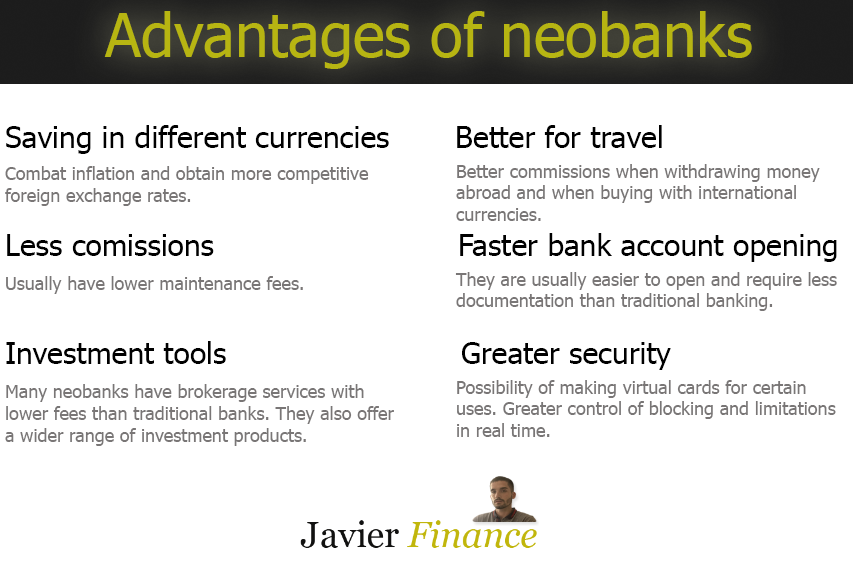

Having a bank account in Switzerland without being a resident can be complicated when you try to do it in traditional entities and without being physically present. There are even companies that are dedicated only to that. However, with the emergence of neobanks and the fintech industry, it is becoming easier and easier.

Dukascopy (Neobank)

It is one of the few proper Swiss neobanks, which can really compete against alternatives such as Wise or Revolut, which are located in other countries. It provides a debit card or virtual card, which is compatible with Apple Pay. This way, you can pay from your cell phone at any merchant. In addition to offering a bank account with Swiss IBAN, they also offer the possibility of investing savings from that account, in investment funds, stock market assets or cryptocurrencies.

Information about Dukascopy’s commissions.

- There are no maintenance fees.

- Dukascopy card has the commission of 2 CHF per month.

- The Swiss Bankers card has 0% monthly fees.

- The balance in gold has a 1% annual fee.

- 1% when buying investment assets.

PostFinance (For immigrants in Switzerland)

It is a Swiss bank that allows non-residents to open bank accounts, well known by immigrants working in Switzerland. The process of opening a bank account with Postfinance is quite simple. You only need to show your identity document, together with a proof of residence in Switzerland. The maintenance fee is not very advantageous compared to other banks or neobanks.

PostFinance Commissions.

- Maintenance fee: 5 CHF.

- ATM withdrawals: free at PostFinance ATMs and 2 CHF at other companies’ ATMs.

It is a more normal bank, where you can physically go to the office and get more traditional services, such as loans in Switzerland or insurance. For example, if an immigrant goes to Switzerland and wants an account, plus insurance for his car, well, he can do it all in one bank and with personal attention. There are many customers who value the fact that they can talk to a real person, in the place where they have their savings. That’s why we’ve included it in this list.

Swissquote (For traders)

Actually its most popular service is not neobank, it is better known for being an online broker that has started to offer “Banking” service, providing an account with Swiss IBAN to its clients and also a debit card to be able to use that money. Also with the ability to make Apple Play or Google Pay. As a broker I do not find it interesting, as it offers investment products with too much leverage and prohibited in certain countries. I don’t think that a 100:1 leverage can be profitable in the medium or long term. Something interesting about this financial company is that it sponsors UEFA (the Euro Cup), so it seems to have a pretty solid image and gives some security.

- Its services are also available for Latin America.

- It is likely that some Spanish clients may have difficulties using some of the bank’s functions, due to regulations with CFDs (Contracts for Difference).

Lombard Odier (For large capitals)

It is a private bank with more than 200 years of history, so it offers what most people are looking for when they want to keep their money in Switzerland, which is that robustness, solvency and security that the Swiss banking system has always offered. It is headquartered in Geneva and has over 300 billion in assets. They have an office in Madrid. In Latin America, they do not have much of a presence, only in Brazil and the Bahamas. As is logical, private banking institutions are not usually aimed at clients with little capital. However, it is good to know that it is possible to be a foreigner and open a bank account with Lombard Odier. Like the previous accounts, this bank is also very focused on investment products.

What are the advantages of saving in Swiss francs?

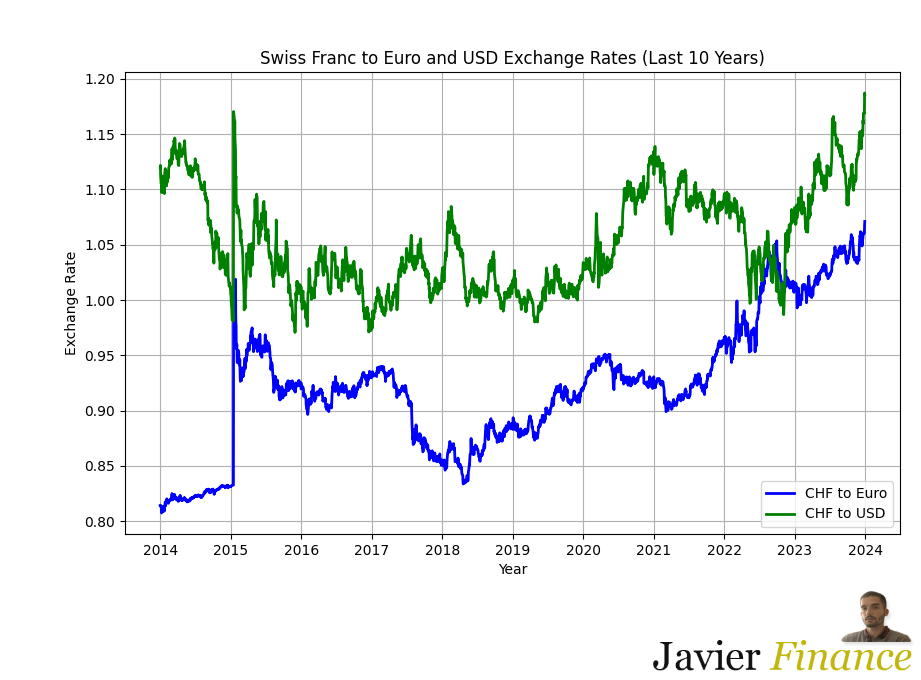

This is the official currency of Switzerland. By having a single currency and not a shared currency, Switzerland has more control over it. Being a small country with a strong economy, it is easier to maintain its value over time, compared to other currencies. Even in recent years it is showing more strength than the euro or the dollar. Throughout history, millions of savers have lost their savings by keeping them in one currency, however, people who had their savings in different currencies have lost less money to inflation. For example, if Argentinians or Venezuelans had saved in Swiss francs in recent years, they would not have lost so much. Some did, but unfortunately the tools and financial culture are not available to everyone.

- Strength relative to other currencies.

- Currency of a small country and easy to manage.

- Currency in a country with a very strong economy.

- Currency of a transparent country with low corruption.

Alternatives to Switzerland for opening a bank account.

Countries are emerging that are competing with Switzerland in the financial sphere. Especially because these are countries that have made efforts to attract foreign entrepreneurship and to have high levels of privacy when it comes to the personal data of the general population.

Open a bank account in Singapore.

Singapore’s banks often offer multi-currency accounts and high banking secrecy. It is one of the most free market countries in the world and the result of these policies has led to the emergence of one of the strongest economies in the world. Investors who used to use the Swiss financial system are now using Singaporean solutions. The Central Bank of Singapore is robust and has proven to offer stability to the country as a whole, even receiving international awards for it.

Open a bank account in the United States.

Although few people know it, the United States is one of the most demanding countries in terms of exchanging bank details of its customers with other countries. In addition, many foreign entrepreneurs decide to create LLC companies (Limited Liability Companies) which offer great tax advantages. Bank accounts in the USA have a guarantee fund of $250,000 dollars. Another advantage of setting up a company in the United States is that it is easier to attract investors, lenders and clients with high purchasing power. The security of having money in the world’s strongest economy with a strong currency also helps many choose the US as the place to open a foreign bank account.

- Neobanks in the USA for foreigners: Payoneer, Globalfy and Zenus Bank.

Open a bank account in the UAE.

Another favourite country for foreigners and international investors is the United Arab Emirates, which has one of the highest levels of banking secrecy in the world and makes few requirements for opening a bank account. The biggest disadvantage in the UAE is that banks often ask for minimum levels of capital or monthly income, with the aim of attracting only wealthy clients. It can also sometimes take several months to open a bank account in the country. It is very important to know that if commercial transactions are made, it is mandatory that they are made with a bank account for companies and not for individuals, as this would be illegal in the UAE.

As you can conclude, although it is one of the favourite countries for foreigners. The requirements and timing, however, are not the best. To open an account in the UAE, you usually go to law firms or specialised companies. It is not so easy to open a bank account in a Dubai neobank. It is a more advanced process, which for many is still very cost-effective and worthwhile.

Open a bank account in Malta.

Malta is a country that belongs to the European Union, so it is very easy to open a bank account as a European foreigner. It is not a tax haven, as it complies with the laws of the European Union, but many consider it as such, because it has very low taxes for international entrepreneurs and does not tax cryptocurrency profits. For example, if a European sets up a company in Malta and is a tax resident there, money earned from other countries is heavily discounted for tax purposes.

It is also a favourite country among foreigners, because they offer solutions that other domestic banks do not have. For example, giving higher returns on annual deposits or greater compatibility with the blockchain industry.

Neobanks in Malta for foreigners: Blackcatcard (for transfers, cards and cryptocurrencies) and Novum Bank (for high yields on fixed deposits).

How can I invest my money in Switzerland?

If you are going to keep your money in Switzerland, you may also want to invest it. Although the currency itself can already be considered an investment, it is possible to get even more out of it with some financial products, such as the following.

- Defensive stocks: you can invest in stocks in general, however, what I find most interesting is to invest in stocks that do not move much, but are backed by the Swiss franc and its economy, such as Nestlé, Roche or even UBS (Switzerland’s largest bank). If you want more risk, it is possible to find opportunities in the pharmaceutical, biotech or luxury sectors.

- Investing in physical gold in vaults: Switzerland is one of the strongest countries in this respect, along with the UK. They offer an account that holds a certain amount of gold in exchange for a fee for the rental and security of the vaults. The most popular companies offering this are Gold Avenue and Swiss Gold Safe.

- Fixed-term deposits and savings accounts: these are very simple options that can also provide a little extra if you don’t want to use the money in the short term. There are also similar investments such as investing in Swiss bonds.

- Swiss real estate sector: by buying property, investing in real estate investment funds or by investing in lending (financing construction/purchase projects). The characteristics of the real estate sector in Switzerland show that in the long term it tends to grow positively. Detailed article on the Swiss real estate sector: https://www.globalpropertyguide.com/europe/switzerland/price-history

My personal opinion.

I think that having a Swiss bank account is something that every good saver should have, because it brings a great sense of security. Especially for people from countries whose currencies are often affected by inflation. It is true that Switzerland still has a bad reputation as a tax haven and that this can cause confusion with the movements of transfers or government administrations. It is therefore important to have clear and transparent accounts, in case you are asked for explanations by bank or government employees.

I am optimistic and positive about investing in the Swiss franc or in Swiss companies.

This same article in Spanish: https://javierfinance.com/es/neobancos-suizos/