I love to write articles on different subjects and also teach other. I consider myself a multipotential person. You can also find me on Youtube or walking in the mountains.

🌟 List of informative posts.

-

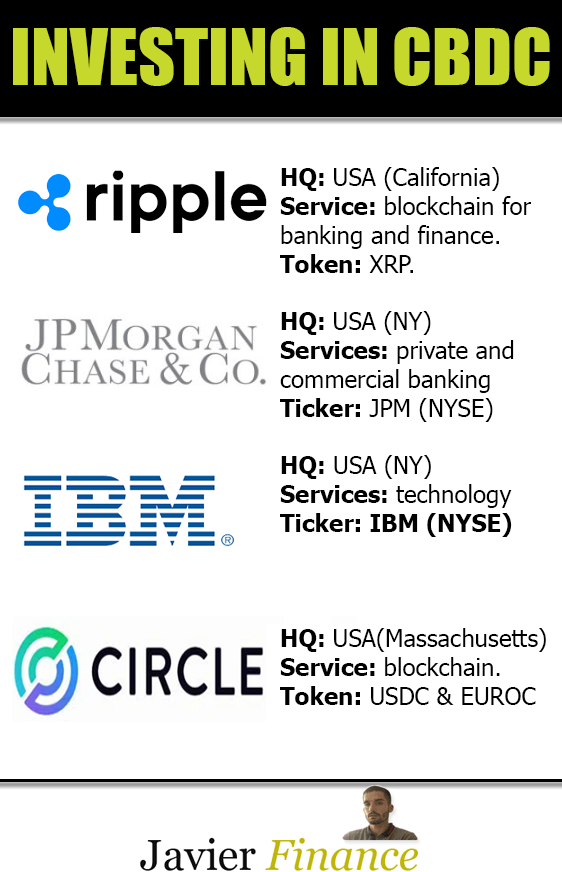

- How to invest in CBDCs🌐 The technology that will revolutionize finance around the world.

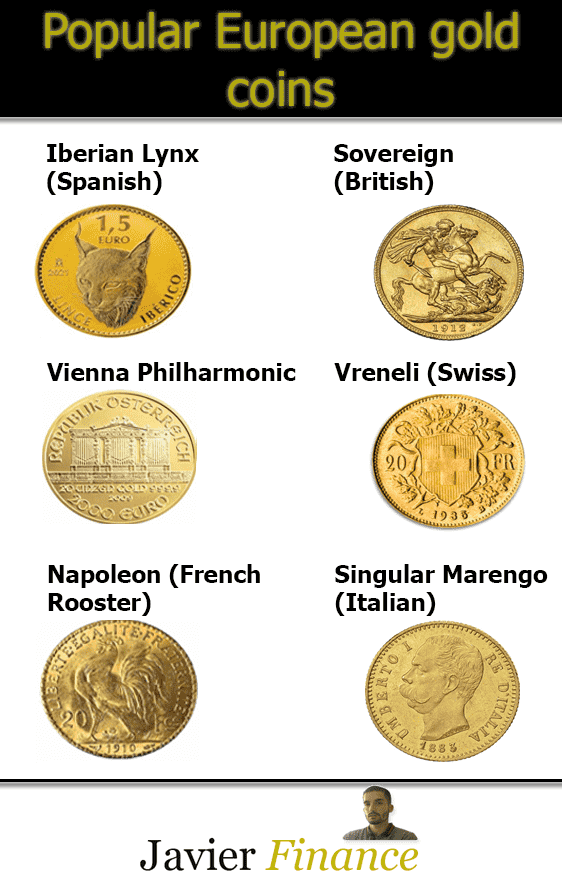

- The Best European Gold Coins💰 Long-term investments in times of inflation.

- The best quantitative trading strategies🚀

Business and Finance.

💰How to invest in CBDCs. May prove to be very profitable for early investors. Some countries already have them in operation.

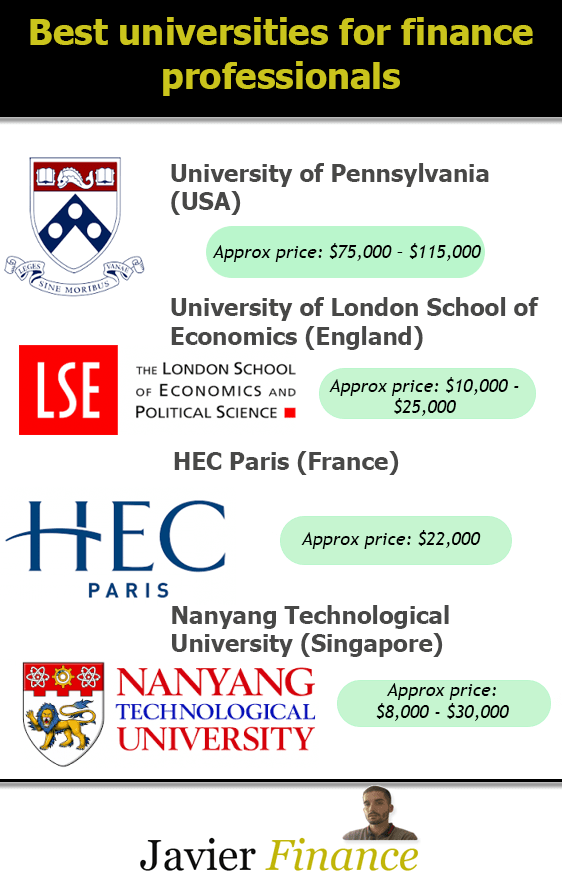

👨🎓The best education: TOP 10 Finance schools in the world. List of the best universities and degrees to work as a financial advisor or stockbroker.

Longevity.

🧬Reduce aging: How to stop skin aging (The Best Ways). The best techniques and information to reduce skin aging.

Computer Science.

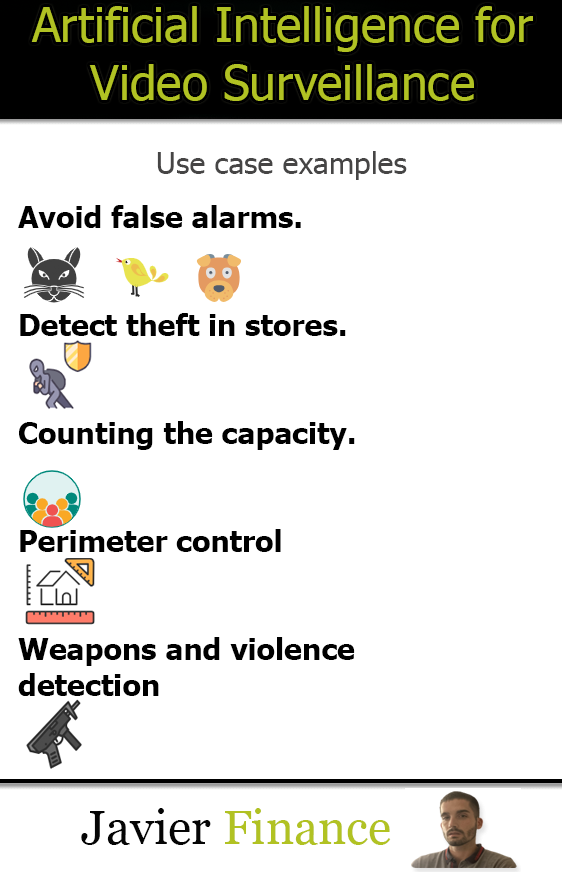

📹Transforming Security: Unleashing the Power of AI in Video Surveillance. Very original and creative ways of using Artificial Intelligence with video surveillance systems, such as the identification of thefts from shop shelves or ATMs.

Metals and jewelry.

🧈Combating inflation: The best European Gold Coins📚. A list of the most demanded gold coins by investors around the world and information on certificates of originality.