Major governments and central banks around the world are working on the development of digital currencies. While the major powers may develop their own, countries that are more independent will have to contract with private companies for their development and adoption.

The best CBDC companies.

Some companies involved in the blockchain world are starting to offer these services and technologies. They are the following:

Circle.

It is a US company and a pioneer in the development of stablecoins. In this case, they are the creators of USDC, a version of the digital dollar. They have also created a digital version of the euro, called EURC. Some banks such as Nubank (Brazil) are in joint projects to work with Circle’s digital dollar, with the possible goal of reaching up to 85 million customers in Brazil.

Companies like Stripe (one of the largest payment gateways in the world) or Yellow Card (1.4 million users in Africa) are already working with the technological integration of this company. In the case of Yellow Card, it is interesting, because Africans can escape the inflation of their currencies by converting them to USDC in a matter of seconds.

Circle plans to go public, so anyone interested in investing in CBDC will be able to do so by simply buying Circle shares.

- Capitalisation: Approx. $9 billion

- Headquarters: Boston (USA)

Ripple.

They are not only a pioneer in the development of digital currencies, but also in the blockchain world in general. The Ripple cryptocurrency (XRP) is called the “Cryptocurrency of the banks” because of its large alliances and banks involved in the development of its technology and services.

Governments such as Georgia and the Republic of Palau have joint projects for the creation of CBDCs for their central banks. Ripple has also acquired companies such as Metaco and Standard Custody & Trust. In the case of Metaco, they work with banks such as BBVA, offering them custody services for their cryptoassets.

Metaco is based in Switzerland and some of its clients include Societe Generale, BBVA Switzerland, Fidelity Investments and Paxos, among others. It should be noted that Fidelity Investments is one of the largest investment fund and pension plan management companies in the world, so its commercial relationship with this company could lead to the creation of very ambitious projects.

Interested in investing in Ripple? Anyone can buy its token (XRP) on the main investment platforms or even from neobanks. Ripple’s good news is often correlated with the price of its token.

- Capitalisation: $10 billion approx.

- Headquarters: California (USA)

JPMorgan Chase.

This bank, which is one of the largest in the world and has been in existence since 1799. It has created its own blockchain network, without relying on third parties. JPM Coin allows the bank’s customers and the bank itself to make faster and cheaper transfers. It is actually a stablecoin, which is linked to the value of the dollar.

The name of the JPMorgan Chase blockchain network is Onyx. On its official website, we can also see that one of its objectives is the tokenisation of investment assets.

It would not be strange at all if governments decided to create their own CBDCs, they would choose JP Morgan Chase as one of the developers of their projects, as this bank is a pioneer in real use cases, having made more than a billion dollars in transfers with JPM Coin.

JPMorgan Chase is listed on the stock exchange and has been doing very well lately. Any individual or company can buy shares in this financial company.

- Capitalisation: $480 billion approx.

- Headquarters: New York (USA)

Consensys.

It is one of the most important companies in the Blockchain world, being the creators and owners of the Metamask technology. When it comes to integrating Web3 solutions into platforms or applications, Consensys’ technology is one of the most secure and widely used.

Consensys is participating in CBDC development projects, for example with the Bank for International Settlements or the Mastercard company. In some of these projects, it is working together with Ripple. There is also news from 2022, which talks about its relationship with Visa on similar projects.

Consensys does not seem to be looking to be a CBDC-specific company. They seem to be more focused on their web3 technology. However, their business relationships and involvement in CBDC projects mean that they are still present in that branch of the industry.

- Capitalisation: $3 billion approx.

- Headquarters: New York (USA)

IBM

They have not been in the news for several years, but they have filed patents that have been published in 2023, related to CBDC systems. In addition to being one of the most advanced companies in the implementation of Hyperledger Fabric technology and its combination with IBM cloud servers.

In 2019, they created their own blockchain project, together with Stellar technology. This allows international transfers to be carried out in a matter of seconds and at lower costs. This service is called IBM Blockchain World Wire, being the main competition of JPM Coin and RippleNet. Some news reports say that more than 40 banks are using this technology to make cross-border transfers.

One of IBM’s biggest advantages is that many banks, businesses and governments already use its services as a technology company. So they only have to offer their new blockchain service to entities that have already trusted IBM for years and are satisfied with its services.

- Capitalisation: $138 billion approx.

- Headquarters: New York (USA)

On their official website it is possible to see that they continue to offer their service to companies that are interested in it.

IBM is listed on the stock exchange, so any person or company can invest in this company.

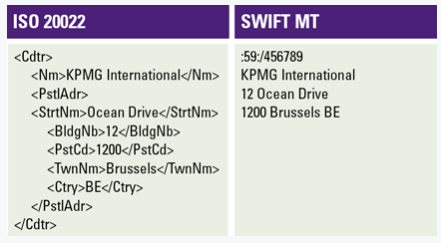

What is ISO 20022?

This is a financial messaging standard that banks use for transactions. This standard is very recent, because banks are just starting to implement it now. It is based on the XML mark-up language.

There are blockchain projects such as Ripple or Stellar, which are members of ISO 20022. Other projects, such as Cardano and Hedera, are also proving to be compatible with this standard.

Each bank transfer or transaction will be accompanied by XML tags with the transfer information. This will make it easier to be interpreted by different types of software related to payment processing, computer security, data analysis or Artificial Intelligence, improving security, reducing errors, increasing speed and improving efficiency in the detection of suspicious transfers, with fewer false positives.

Within the same transaction, several bank transfers can be made at the same time. Thanks to the use of the tag: <TransactionGroup>.

Adoption of ISO 20022 worldwide:

Which countries are leading the way in CBDC?

Some countries already have their digital currencies at a very advanced stage. They are as follows:

China (Yuan Digital)

Under the acronym e-CNY, digital yuan is already available and can be paid with digital yuan in China. The digital Yuan is compatible with smart wristbands and hardware, and can be used as a wallet or payment method. It is even possible to pay with digital yuan without electricity. It is also compatible with WeChat, China’s most widely used app.

One thing that has been criticised about the Digital Yuan is that it has the ability to “expire”, so that a feature could be added that it has to be consumed until “x” date, in order to increase consumption and make it difficult to save foreign currency. However, this feature is not being rolled out to consumers at the moment.

Bahamas (Sand Dollar)

It is the first country to officially have a digital currency. It uses Hyperledger Fabric blockchain technology, which is a Linux blockchain project. This technology is also among IBM’s favourites to offer its blockchain services.

The Bahamian government has offered incentives to its residents and businesses to use this new payment technology, such as discounts, rebates and rewards. With the facility to make payments by reading QR codes.

Sand Dollar’s objectives: faster payment speed, less discrimination (digital wallets for minors or immigrants) and less tax evasion.

This CBDC has its own official website called Sanddollar.bs, with all kinds of information and resources.

The European Union (Euro Digital)

The Central Bank of the European Union is also developing its own CBDC. On the official website of the European Central Bank, there is a lot of information and documentation about this digital currency. The official sources do not publish, for the moment, the type of technology it uses, however it is possible that it uses DLT technology.

The implementation of the Digital Euro is being hotly debated and is not clear at the moment. There are claims of detrimental effects on privacy, possible negative effects on the financial industry, and little improvement for lifestyle in general. In other words, the digital euro is not really needed.

Other countries that have digital currencies at a very advanced stage: Sweden, Jamaica, Nigeria and Palau.

What are the disadvantages of CBDCs?

- Less privacy: according to most people, this will allow governments to control their citizens’ spending and set spending limits. Although the European Union, for example, argues that it wants its CBDC to maintain a minimum level of privacy, public distrust is real. In the Bahamas, for example, it is possible to create a digital wallet without identification, as long as it does not exceed $500 in savings or $1,500 in spending per month.

- Expiring money or savings limits: If you want to save, this can be a disadvantage. If the digital wallet has a maximum savings limit, CBDCs could have the possibility of expiring, so as to increase consumption or simply not allow you to save up to certain amounts.

- Withdrawal limits: if you want to convert from CBDC to cash, there may also be limits or no possibility of doing so. According to governments, this is an advantage for them, as it avoids the emergence of credit crunches.

- Negative effects on the financial industry: the elimination of intermediaries, such as credit card companies or certain banking services, could lead to financial losses and create thousands of redundancies, leaving workers in the financial sector unemployed. This is one of the biggest disadvantages I see for its adoption, as banking has a lot of power in society and many people make their living from it.

- They could be hacked: despite the fact that one of the priorities during their creation is that they should be as secure as possible. The fact that they are based on computer systems opens up the possibility of security breaches.

- Too much power for central banks: having greater power over the money supply, in the wrong hands, can create economic manipulation or abuse of power. Even if well-intentioned, major changes can have too radical an effect.

Are they going to replace cash altogether?

Whether cash will disappear depends to a greater extent on the type of CBDC used in each country. Some countries will want a hybrid system, while others will want to move to a fully digital system.

In the European Union, the European Central Bank argues that it prefers a system in which cash continues to exist. However, at present, there are already limits on cash payments in certain countries, for example in Spain, France and Italy, with very strict limits of, for example, €1,000. With a great deal of discontent among the population.

In the United States, certain politicians have promised their voters that with them there will be no CBDC. So, if it is also applied to other countries, it could be the case that this technology will only be used for international payments or for voluntary use.

My personal opinion.

My opinion regarding investing in CBDCs (This is not a financial advice) is that, being a sector that is still developing, it is possible that it can be very profitable to invest in companies that are already using this type of technology for their own benefit or working on large projects. Such is the case of JPMorgan Chase, which has this technology in a very mature stage or in companies like Ripple, which already have created a large international structure.

In addition to seeing this technology as an investor. As a technology professional, it can also be very profitable to master technologies such as Hyperledger Fabric or blockchain technology in general, such as the creation of smart contracts or tokenization of assets.

Read this article in Spanish: https://javierfinance.com/es/como-invertir-cbdc/